AI close management software is a paradigm shift for finance teams wanting to reduce busywork, reduce stress, and focus on higher-value work.

For years, close management software has been built around coordination: assigning tasks, tracking progress, and gathering approvals to keep the close organized—not doing the actual work of closing

Meanwhile, the actual work stays manual and scattered across systems, putting strain on finance teams to rebuild reconciliations every period, roll forward schedules manually, re-create journal entries, and explain variances at the last minute.

With advancements in AI, all of this can now change.

AI is now being used to execute parts of the close process itself. With Ledge, finance teams can create AI agents for each close task that follow the company’s existing logic, formats, and data—giving every close task the equivalent of its own digital staff accountant that works in the background, on behalf of the team.

Accounts can be reconciled continuously. Working papers can be rolled forward automatically. Journal entries and draft variance explanations can be prepared before close week begins.

Instead of starting each close from scratch, finance teams can start the close process with real work already done.

Below are the core AI close management use cases that Ledge makes possible.

1. Automate account reconciliations throughout the close

(Instead of rebuilding reconciliations from scratch in Excel every period)

The challenge

Reconciliations are still one of the most time-consuming and error-prone parts of the close.

Balances are exported from NetSuite and pasted into spreadsheets next to bank statements, payment processor reports, and subledger data. Each account—bank, payment processor clearing, intercompany, accruals, prepaids, deferred revenue, tax—ends up with its own workbook, logic, and owner.

Variances only surface at close when balances don’t tie out, forcing last-minute fire drills to track down exceptions. Audit prep is just as painful, with supporting evidence scattered across shared folders and email chains.

How Ledge solves this

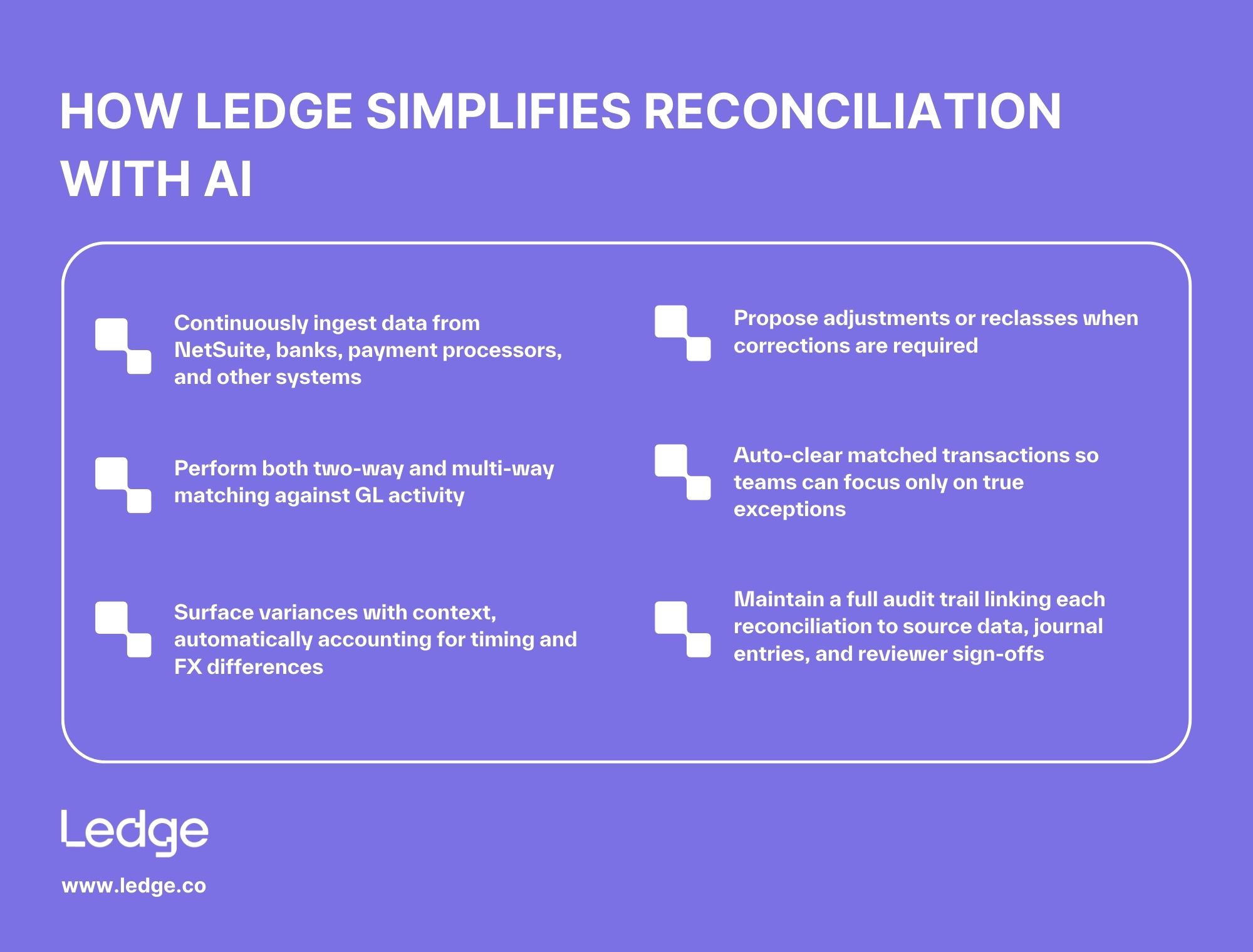

Ledge automates any account-to-account or source-to-source reconciliation as part of AI close management. AI agents:

- Continuously ingest data from NetSuite, banks, payment processors, and other systems

- Perform both two-way and multi-way matching against GL activity

- Surface variances with context, automatically accounting for timing and FX differences

- Propose adjustments or reclasses when corrections are required

- Auto-clear matched transactions so teams can focus only on true exceptions

- Maintain a full audit trail linking each reconciliation to source data, journal entries, and reviewer sign-offs

Instead of manually assembling reconciliations, accountants open the checklist and see balances already tied out, variances explained, and entries drafted for review.

2. Generate and roll forward working papers automatically

(Instead of rebuilding accrual, deferral, and support schedules manually every month)

The challenge

Working papers underpin the close but remain very manual and repetitive. Finance teams often start by fetching data from NetSuite, payroll, billing, banks, and other systems.

It takes finance teams a lot of busywork just to get the close started.

When rebuilt manually in spreadsheets, working papers are fragile. Roll-forwards depend on copied tabs, linked formulas, and manual updates that break silently as files grow more complex. A single Chart of Accounts or segment change can force teams to add rows, rewrite formulas, and re-tie totals across multiple schedules.

Manual accruals make this worse. Items like legal fees, cloud spend, retainers, and payroll are estimated in Excel, then reconciled later when actuals arrive. That creates downstream clean-up: true-ups, reclassifications, and repeated variance explanations when estimates don’t line up.

By the time auditors review the close, support for these working papers is scattered across spreadsheets, ERP exports, and screenshots. Recreating how a number was built becomes a project of its own, even when the underlying logic hasn’t changed.

How Ledge solves this

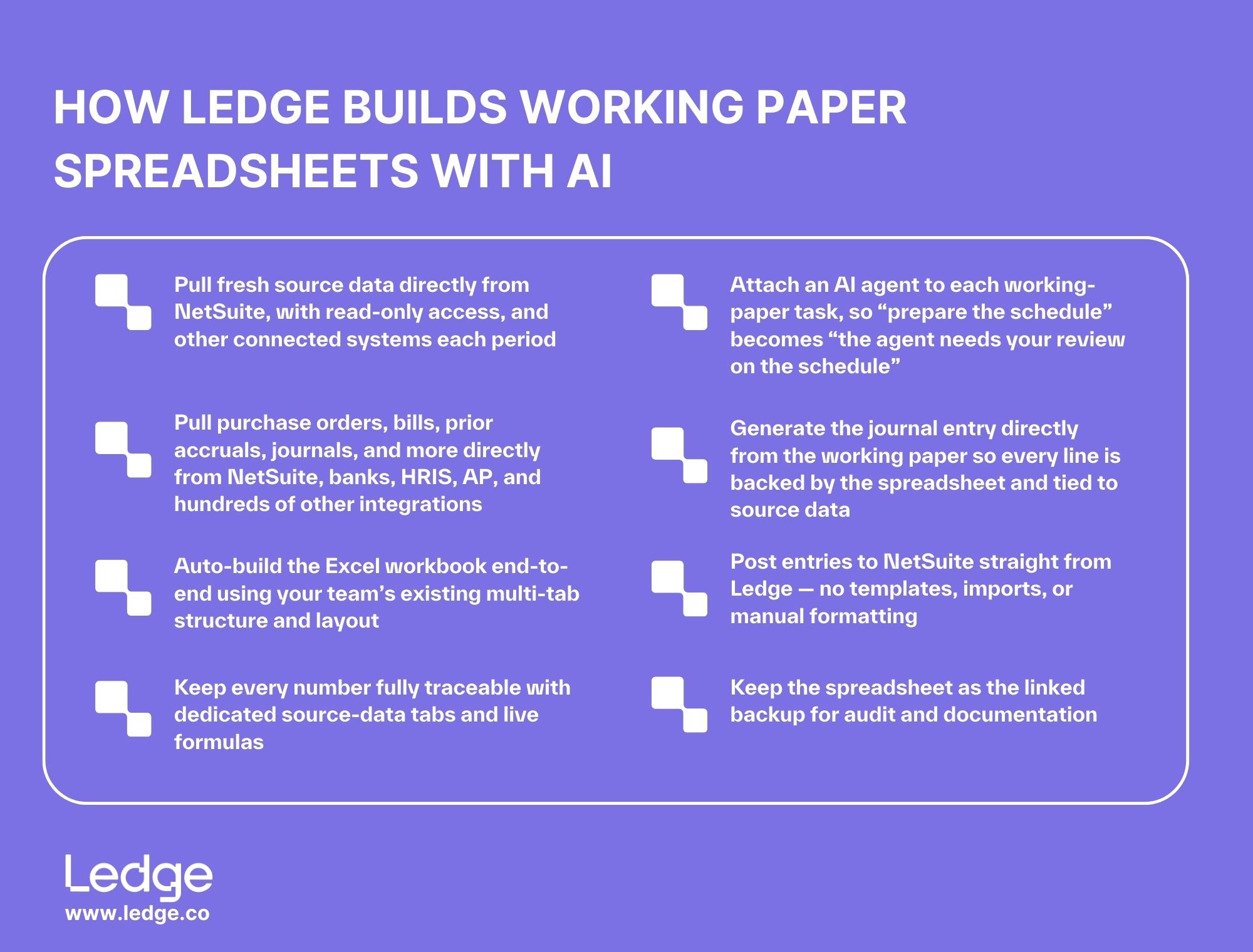

Ledge builds the working paper Excel spreadsheet for you, with AI agents that take the following steps:

- Pull fresh source data directly from NetSuite, with read-only access, and other connected systems each period

- Pull purchase orders, bills, prior accruals, journals, and more directly from NetSuite, banks, HRIS, AP, and hundreds of other integrations

- Auto-build the Excel workbook end-to-end using your team’s existing multi-tab structure and layout

- Keep every number fully traceable with dedicated source-data tabs and live formulas

- Attach an AI agent to each working-paper task, so “prepare the schedule” becomes “the agent needs your review on the schedule”

- Generate the journal entry directly from the working paper so every line is backed by the spreadsheet and tied to source data

- Post entries to NetSuite straight from Ledge — no templates, imports, or manual formatting

- Keep the spreadsheet as the linked backup for audit and documentation

3. Automatically draft and post recurring and exception journal entries

(Instead of rebuilding and re-uploading journal entries every close)

The challenge

Journal entries are still one of the most manual parts of the close.

Teams rebuild JEs in Excel or CSV files and upload them into NetSuite each period, repeating the same steps close after close. Small format issues or validation errors can cause imports to fail, forcing teams to fix files, re-upload, and re-review entries they already approved..

Adjustments such as FX revaluations, intercompany eliminations, and reconciliation corrections are also prepared manually, which increases the risk of errors and inconsistencies. Recurring entries, from payroll to amortization to allocations, must be re-entered every month, adding repetition to an already compressed timeline. Documentation for these entries is often incomplete or dispersed across folders and emails, which can lead to painful audit findings when support isn’t easily traceable.

Errors frequently surface during the approval process, creating rework and slowing down the final stages of the close. The cumulative effect is a heavy, error-prone workflow that adds pressure to an already demanding month-end cycle.

How Ledge solves this

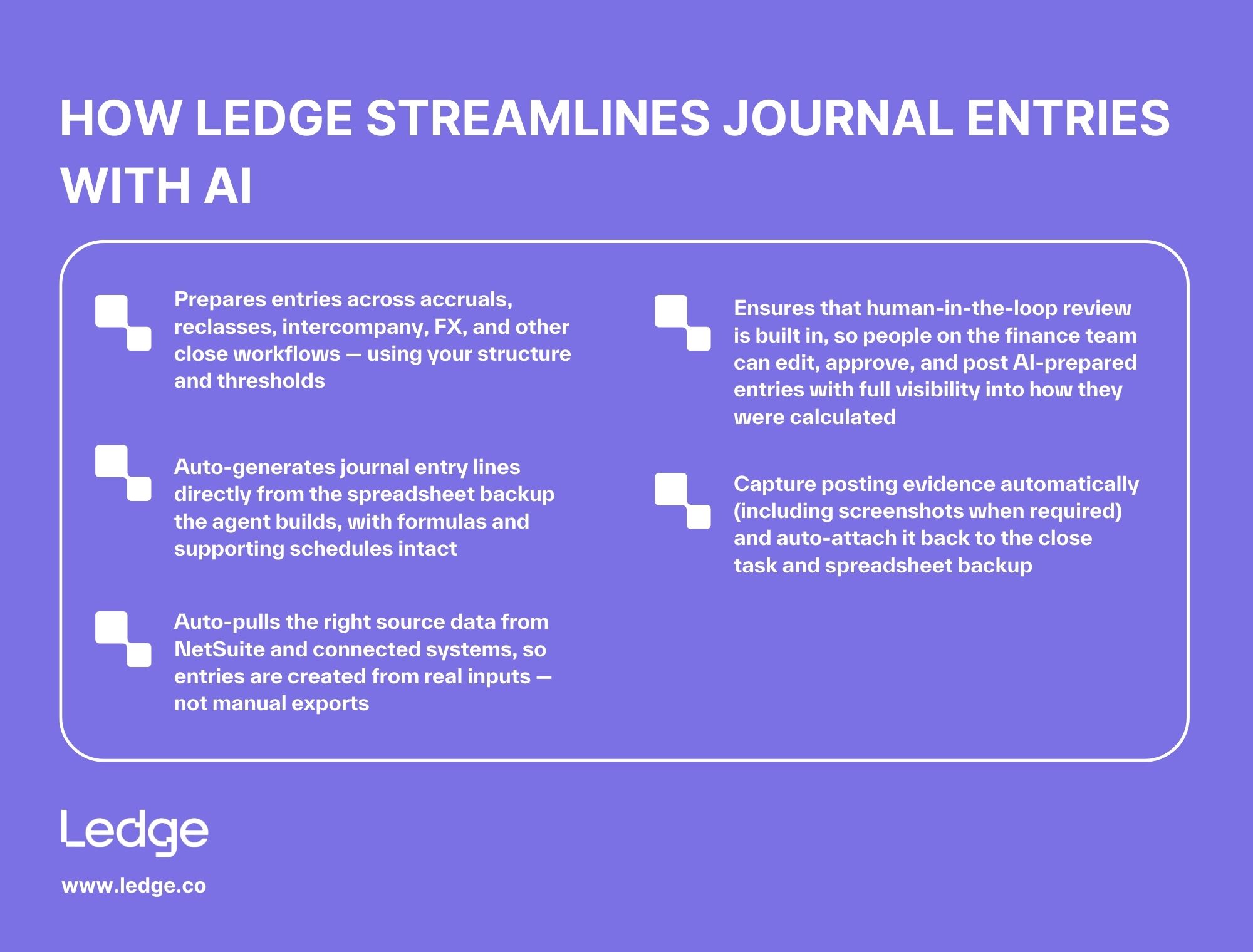

Ledge doesn’t treat journal entries as standalone files to be rebuilt and uploaded. It treats them as the output of executed accounting work. Ledge’s AI:

- Prepares entries across accruals, reclasses, intercompany, FX, and other close workflows — using your structure and thresholds

- Auto-generates journal entry lines directly from the spreadsheet backup the agent builds, with formulas and supporting schedules intact

- Auto-pulls the right source data from NetSuite and connected systems, so entries are created from real inputs — not manual exports

- Ensures that human-in-the-loop review is built in, so people on the finance team can edit, approve, and post AI-prepared entries with full visibility into how they were calculated

- Capture posting evidence automatically (including screenshots when required) and auto-attach it back to the close task and spreadsheet backup

4. Start flux analysis with AI-driven explanations

(Instead of hunting through GL data at the last minute to explain what changed)

The challenge

Flux analysis is essential but difficult to complete in practice.

Finance teams dig through GL and subledger data to figure out what changed and why. Drivers are hard to pinpoint, tools are limited, and explanations are frequently shallow, repetitive, or written under deadline pressure after the close.

This reactive approach slows reporting, limits insight into business drivers, and makes it hard for finance leadership to get clear, timely variance explanations.

How Ledge solves this

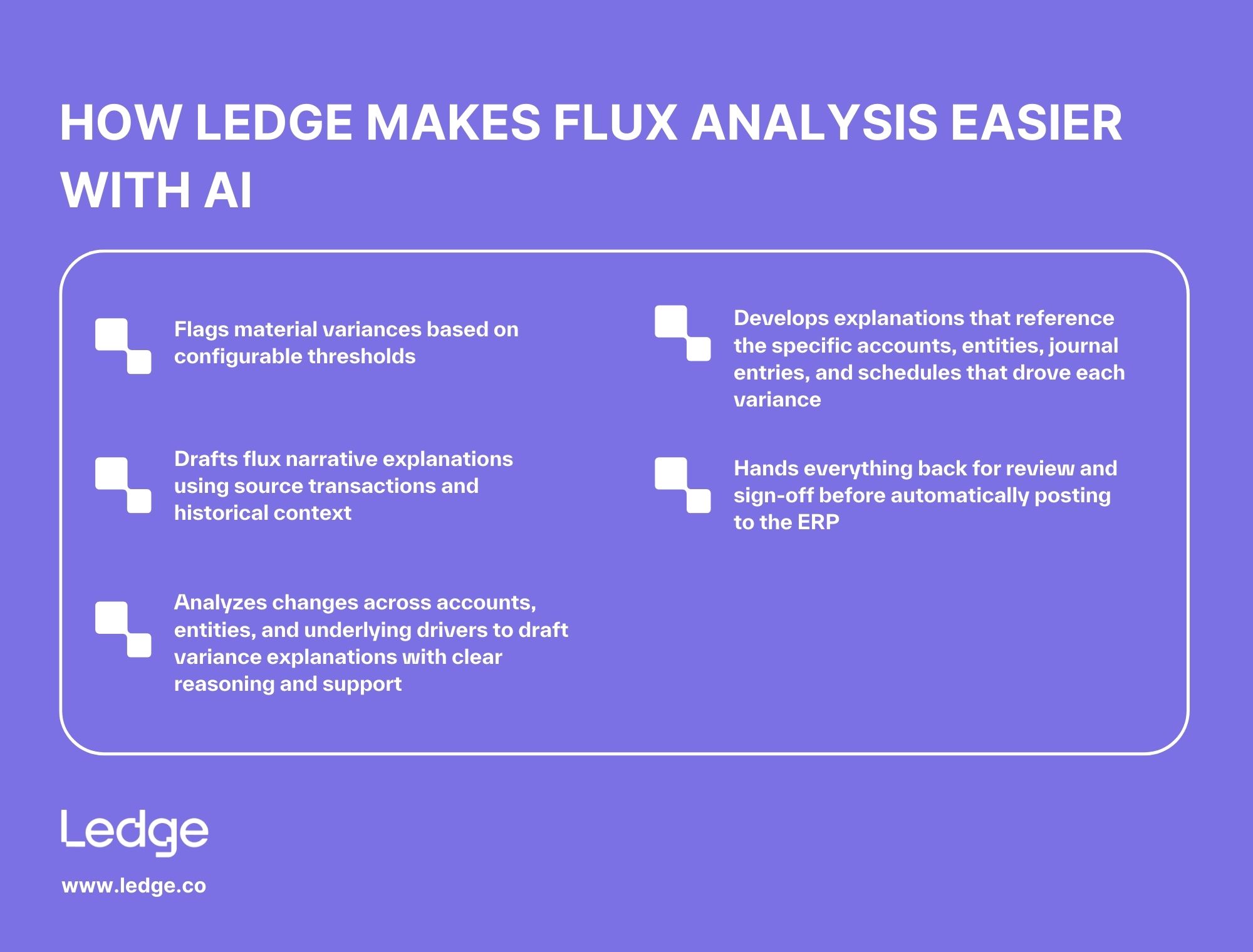

Ledge’s AI automates flux analyses, so finance teams always start with an insights-led draft view of what moved and why. Ledge’s AI:

- Flags material variances based on configurable thresholds

- Drafts flux narrative explanations using source transactions and historical context

- Analyzes changes across accounts, entities, and underlying drivers to draft variance explanations with clear reasoning and support

- Develops explanations that reference the specific accounts, entities, journal entries, and schedules that drove each variance

- Hands everything back for review and sign-off before automatically posting to the ERP

Accountants refine and confirm the narrative instead of building it from scratch. Finance leadership sees meaningful variance explanations earlier and in richer context.

5. Make the close agentic, not just a task list

(Instead of using checklists that track tasks but do not contribute to completing the work itself)

The challenge

Most close checklists, whether in Excel or inside close management tools, function as static task lists rather than true workflow engines. Excel-based checklists are fragile, entirely manual, and disconnected from the systems they depend on.

Because these checklists lack dependency awareness, delays in one task often go unnoticed until they cascade into downstream bottlenecks. Controllers then spend hours chasing updates, reconciling conflicting information, and manually tracking progress across the team.

How Ledge solves this

Ledge’s checklist is agentic and integrated. Because Ledge connects directly to NetSuite, banks, payment processors, and other systems, workflow-specific AI agents pre-complete tasks with real work:

- Reconciliations tied out and attached to the task

- Working papers rolled forward and pre-populated with current data

- Journal entries drafted and ready for review and approval

- Live data pulled from source systems so teams review instead of rebuild

- Dependencies and bottlenecks surfaced automatically, with clear risk indicators

- Approvals and evidence captured in one system with a complete history

When accountants open a task in Ledge, they start in review mode rather than spreadsheet-building mode.

6. Apply and reconcile cash daily as part of continuous accounting

(Instead of manually matching payments and remittances during close week)

The challenge

Cash application tends to be highly manual and fragmented. Payments frequently arrive without clear references, and the associated remittance details are buried in PDFs, customer portals, or email threads. To match these payments to open invoices, teams resort to spreadsheets and spend hours each week manually pairing transactions.

When cash remains unapplied, AR aging and DSO become distorted, creating unnecessary noise for collections teams who may end up chasing customers that have already paid. Supporting documentation is scattered across sources, which makes audit preparation slow and difficult.

How Ledge solves this

Digital accountants within Ledge apply cash daily and connect that work back into the broader close and reconciliation workflows. The agents:

- Extract remittance details from PDFs, portals, and inboxes

- Match payments to open invoices using AI-powered pattern matching

- Auto-apply confident matches and flag exceptions with suggested links

- Support multi-entity, multi-currency environments

- Maintain a complete, system-generated audit trail for every applied payment

Cash application becomes a continuous, automated process, keeping AR aging clean and DSO accurate daily while reducing manual matching.

AI close management isn’t years away

It’s already dependable enough to operate within accounting policies, approval protocols, and audit requirements.

With AI agents preparing close workflows and humans validating each step, finance teams gain both efficiency and increased strategic capacity. The time once spent rebuilding reconciliations or assembling working papers can now shift toward higher-value work: analyzing trends, advising leaders, and strengthening the financial foundation of the business.

Efficiency improves, control stays intact, and the finance team moves up the value chain.